Bajet 14, my take?

Last Friday was the day many of us Malaysians are eagerly waiting for each year without fail. It's budget day! When I was young, I never really understood what is so important about this day; I never got it why people were so excited sitting in front of the television watching our Prime Minister presenting next year's budget. He's just allocating money, big deal. Now is a different story altogether.

Allow me to begin with my take on the proposed budget.

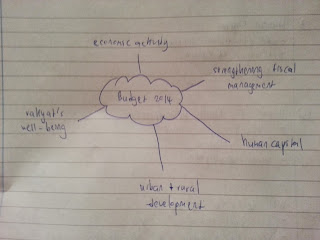

Below are the so-called thrusts for next year's budget. These are the key areas/focus of the budget.

Lets go through it one by one shall we? Because this is just a blog, I will simply breeze through it, stopping only to pick up things of which I find rather interesting.

1. Invigorating Economic Activity

Aviation industry finally got the limelight it deserves after all these years. Quoting the text, "the industry will have a multiplier effect on the economy in line with growing demand for passengers and air cargo." Upon observing the big growth potential in the sector, it is wise to make an operational improvement now. The proposed replacement of air traffic control management system in Subang and a new air traffic management centre in KLIA would surely be of worth. Not only that, such a plan also comes at a good timing given that by May next year, KLIA2 will finally be up and running, thus the decision to start work on new air traffic management system from now is a gesture of good planning.

The other thing that caught my attention is the entrepreneurship. Regardless of how he made his entry into the section with the mention of the infamous hadith that states nine parts of one's sustenance is in business, lets just focus on the issues brought forth into the discussion. It is true that SMEs do generate a significant contribution to the GDP, by around 32.4%. I highly applaud the move to further encourage these enterprises to innovate and become more productive. Not only that these type of businesses are commonly found to be resilient in times of crises, but the spillover impact that they have in empowering the people should not be taken lightly. They are not just creating jobs for people; they form a livelihood for them, providing them the skills and above all, the flexibility for them to do business in markets one may never even heard off. What better way to promote creative entrepreneurship in a country that is abundant in natural resources like ours eh?

Lastly, just to touch them on the surface the petroleum and tourism sector are not to be forgotten. The announcement of new projects to be undertaken by Petronas in the coming years is nothing new. Who could blame them; the corporation does have a huge contribution, if not one of the largest to our economy. The tourism sector on the other hand, well maybe its contribution is less so, but then again, tourism is one of most successful ways to showcase a country in a global scale. It is one way we could make our presence be known to others, plus by attracting foreigners in, they provide important insights as outsiders on how else we could further enhance our services sector, but then again, it is their spending power that we seek actually. It's a known fact that tourists do spend a lot, especially when their home currency is stronger than ours, which was why we welcome their presence so much.

2. Strengthening fiscal management

Now this is when things start to get more interesting. First of, lets talk one thing that everybody around the world hates, taxes. As the Benjamin Franklin would put it, 'there things that are certain in life are death and taxes'. Surely nobody likes it when people try to take your hard-earned money away from you. What more when you are not sure whether you will see the money again. In other words, it is one thing that you forced to pay taxes, but what makes it worse is the fact that in no way that you are certain that all of that tax revenue would be put into good use as it was initially intended for.

The decision to implement the Goods & Services Tax (GST) at 6% level was met with equally support and backlash. For one, the rate is in itself pretty high. Yes, it is still relatively low compared to other countries, but to introduce a new tax regime at such a rate is a risky move, I must say. Without a doubt this would cause our inflation rate to rise. I agree that if we are to accomplish such a feat, now is a good time to do so, with our inflation at 2% and all, but why make the rates so high? Also, the much bigger question is the implementation mechanism itself.

I would have hoped that the govt to have prepared a properly outlined mechanism as soon as the GST is announced during the budget tabling. Unfortunately, they did not. It would not only clarify a lot of things to the people, but also it reflects on your credibility. Announce something new briefly in parliament, then get a document on the mechanism ready to be published as soon as you do so, that'll look so good on your part.

The same actually holds when we talk about subsidy rationalization. It is understood that if left unattended our country will inevitably run into twin deficit problems: public and external deficit problems as already warned by few ratings agencies. But if we are able to plan ahead and provide solid mechanisms on how we aim to solve the matter, then again it would prove to these rating agencies that yes, we admit we are having issues, but we would soon rectify them by doing this and that. You are smart, surely you know what to do, so why not put it down in ink so that we can all understand it better, for all of our sakes.

I leave the rest to you…….

Comments

Post a Comment